Work Clothing Tax Deduction 2025. Yet, 90% of small business owners miss this deduction. The amt exemption amount for tax year 2025 for single filers is $85,700 and begins to phase out at $609,350.

Promotional attire for your employees. Work clothes are tax deductible if your employer requires you to wear them everyday but they cannot be worn as everyday wear, such as a uniform.

This will change in 2025, when employees can take a uniform for work tax deduction, but not until then, thanks to the 2017 tax cuts and jobs act (tcja).

Men’s work clothing + the purchase price Arad Branding, Tax credits and deductions can be key to reducing what you owe come tax. 84 rows the tax relief will reduce the amount of tax you pay.

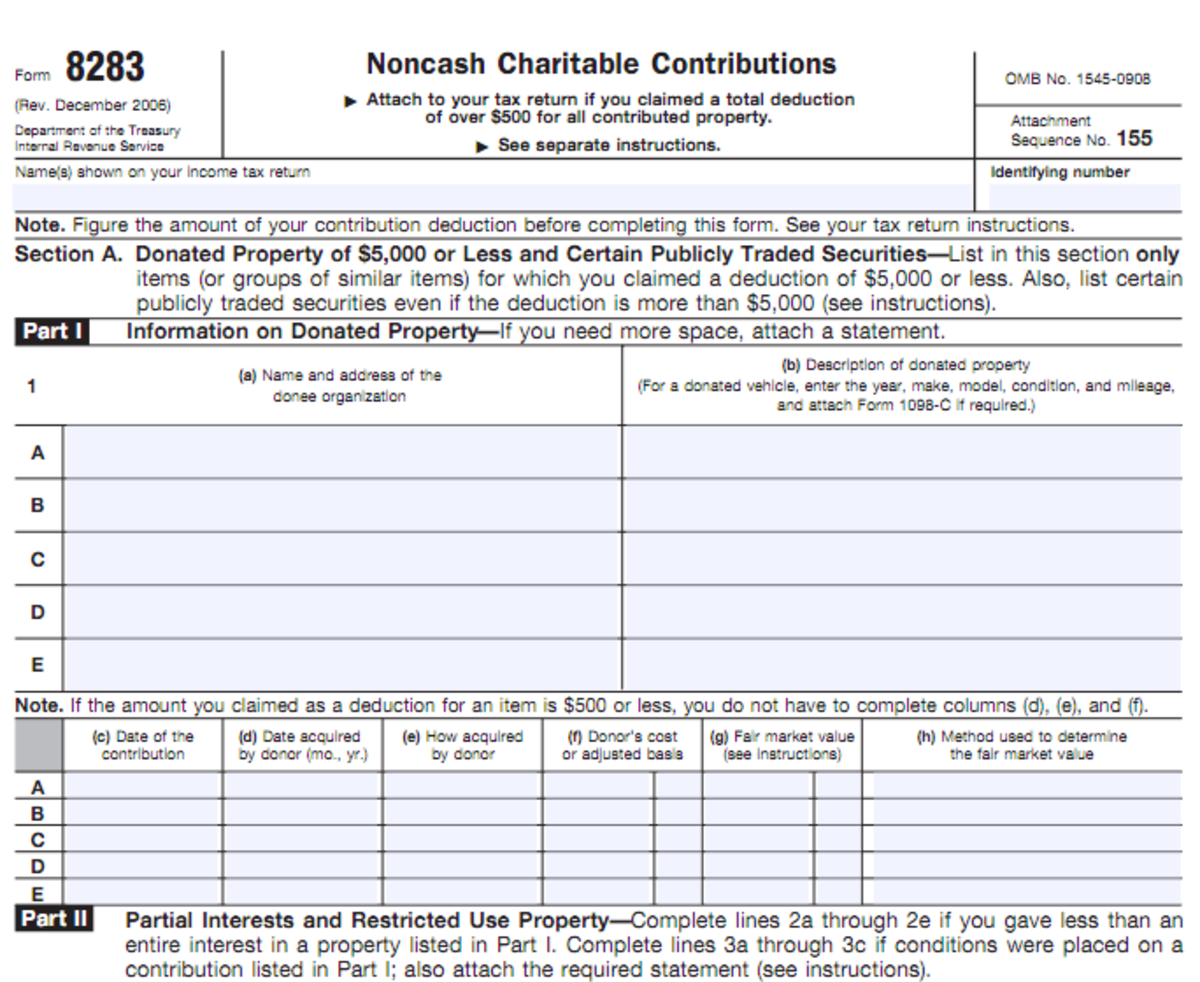

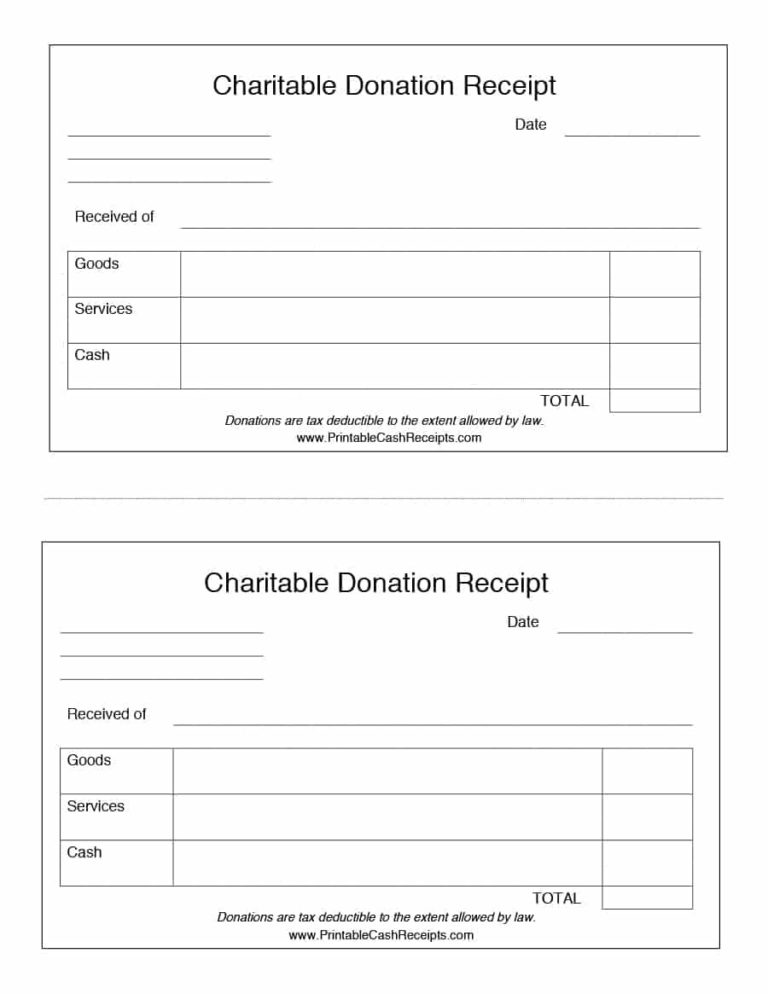

Clothing and Laundry To Claim A Deduction For WorkRelated Expenses, Are charitable contributions tax deductible? This article will explore the circumstances under which clothing may qualify for a tax deduction, offering guidance on which expenses may be eligible and how to properly.

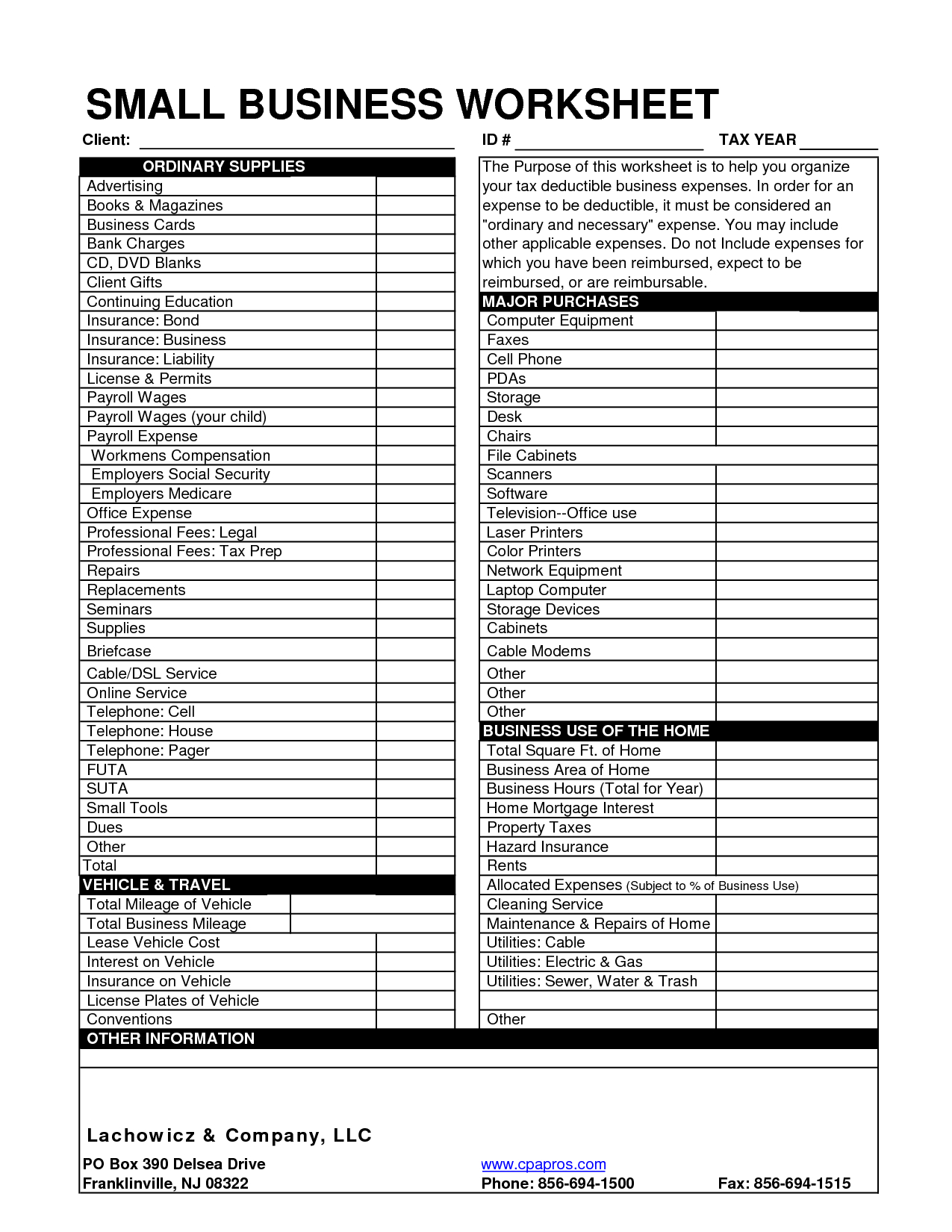

Tax Donation Spreadsheet with regard to Clothing Donation Tax Deduction, 84 rows the tax relief will reduce the amount of tax you pay. This includes the cost of the clothing itself, and the cost of.

Clothing Donation Tax Deduction Worksheet 20122025 Form Fill Out and, Are charitable contributions tax deductible? The amt exemption amount for tax year 2025 for single filers is $85,700 and begins to phase out at $609,350.

How to Get a Clothing Donation Tax Deduction ToughNickel, Promotional attire for your employees. Therefore, in this guide, we’ll investigate when you can claim clothing as a business expense.

Tax Deductions Clothing Donation Value Money Blue Book Tax, You can claim a deduction for medical and dental expenses greater than 7.5% of your adjusted gross income if you itemize your. Here's what you need to know when filing your 2025 tax return.

Clothing Donation Tax Deduction Worksheet —, Generally, if you provide a benefit such as special clothing, an allowance or a reimbursement for special clothing to your employee, the benefit is taxable. You can apply a 3% flat tax deduction from your net income.

Tax Deduction for Work Clothing & Uniform?, What work clothing can be claimed? Learn about the tax deductibility of uniform expenses for work under the tax cuts and jobs act (tcja) of 2017 and find out about exceptions and eligibility criteria.

Federal 2025 Tax Rates Image to u, For example, if you claim a flat rate expense of £60 and pay tax at a rate of 20% in that year, you will. Is it necessary and usable only for work?.

Standard Deduction 2025 Age 65 Standard Deduction 2025, This includes the cost of the clothing itself, and the cost of. Are charitable contributions tax deductible?

Work clothes are tax deductible if your employer requires you to wear them everyday but they cannot be worn as everyday wear, such as a uniform.