Sss Employee Contribution 2025. Easily calculate your monthly contributions based on your income and employment status. Employer (er) and employee (ee) employer (er) refers to the entity or individual who hires employees and is responsible.

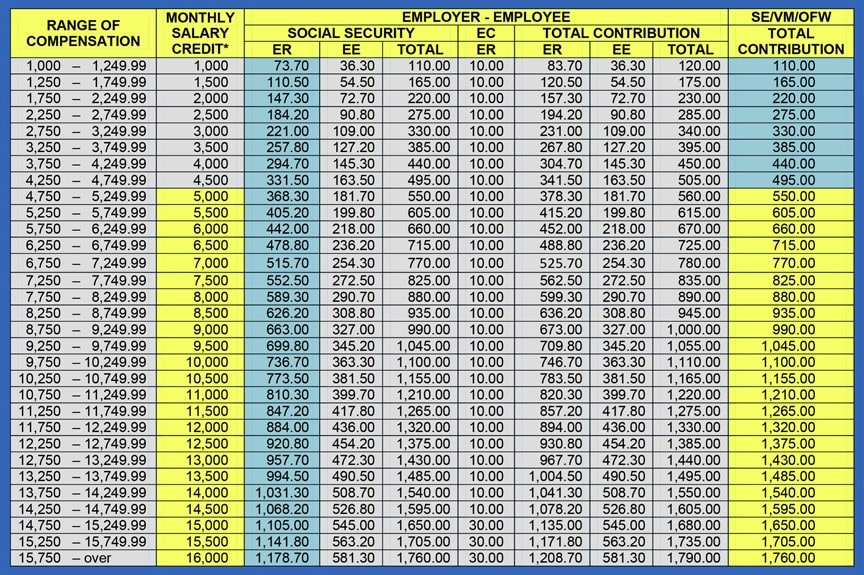

Find your contribution bracket and plan for your future retirement benefits. In 2025, the sss contribution rate was set at 13%.

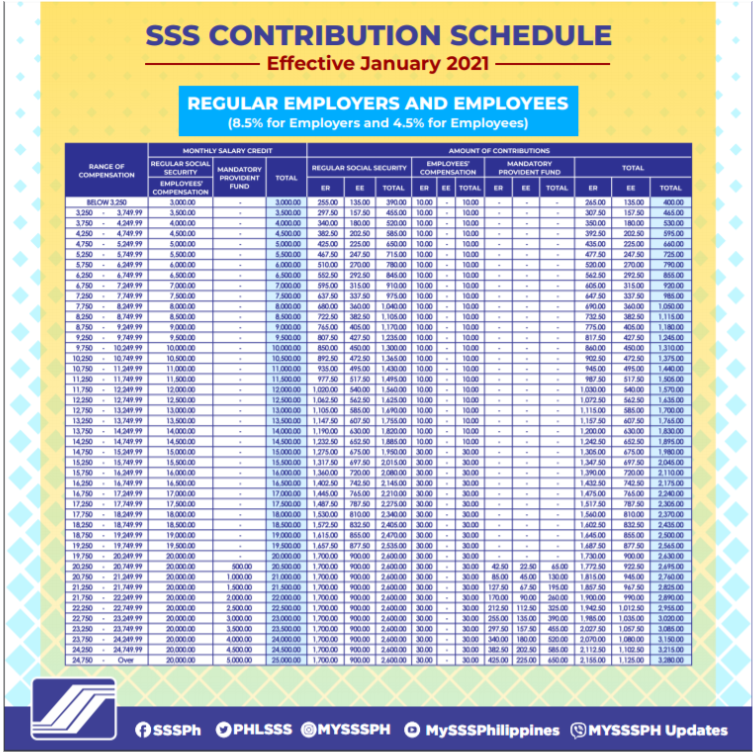

In 2025, the social security system contribution rate has been set at 14%, of which 9.5% is for employers and 4.5% is for employees.

SSS Contribution Table 2025 SSS Answers, Stay updated on your sss contribution with this new sss contribution table 2025. For 2025, the sss contribution rate is still 14%, as with the previous year.

How To Compute Sss Contribution Explaining In Details, Updated in the payment of the sss. Find your contribution bracket and plan for your future retirement benefits.

How to Compute Our SSS Monthly Contribution 2025 & 2025 eezi, Here are the eligibility requirements for application: Access your sss account online and enjoy convenient services such as viewing your contributions, applying for loans, and more.

SSS Contribution Table 2025 (with Detailed Computations & Explanations), Stay updated on your sss contribution with this new sss contribution table 2025. Updated in the payment of the sss.

![[UPDATED] SSS Contribution Table 2025 PIHLC](https://pagibighousingloancal.com/wp-content/uploads/2023/06/image-9.png)

[UPDATED] SSS Contribution Table 2025 PIHLC, What is the sss contribution rate for 2025? You have probably noticed this increase on.

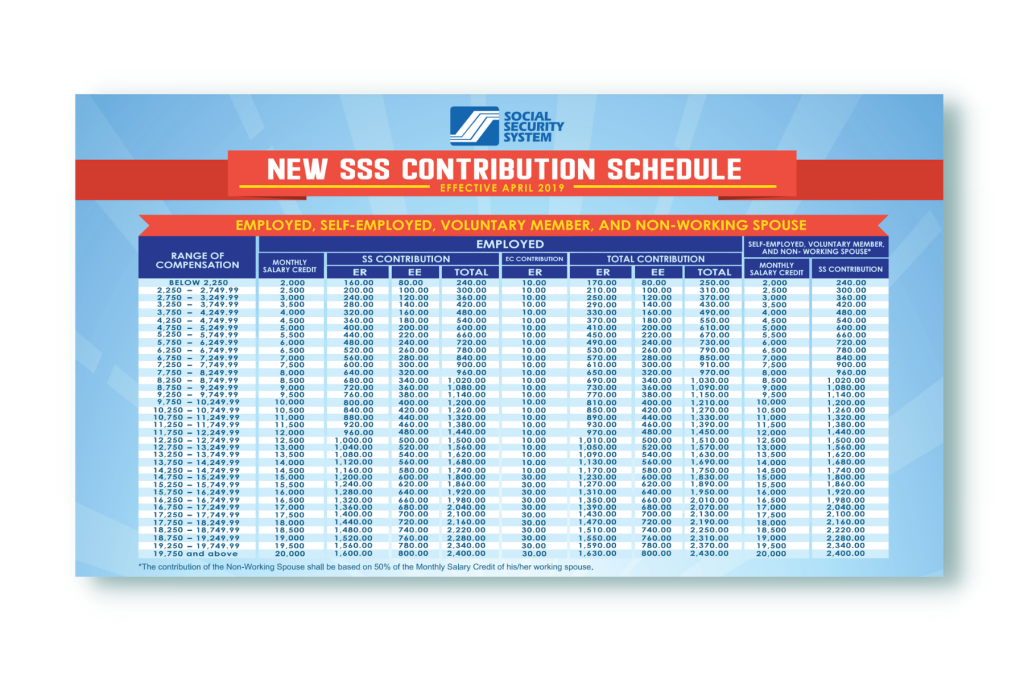

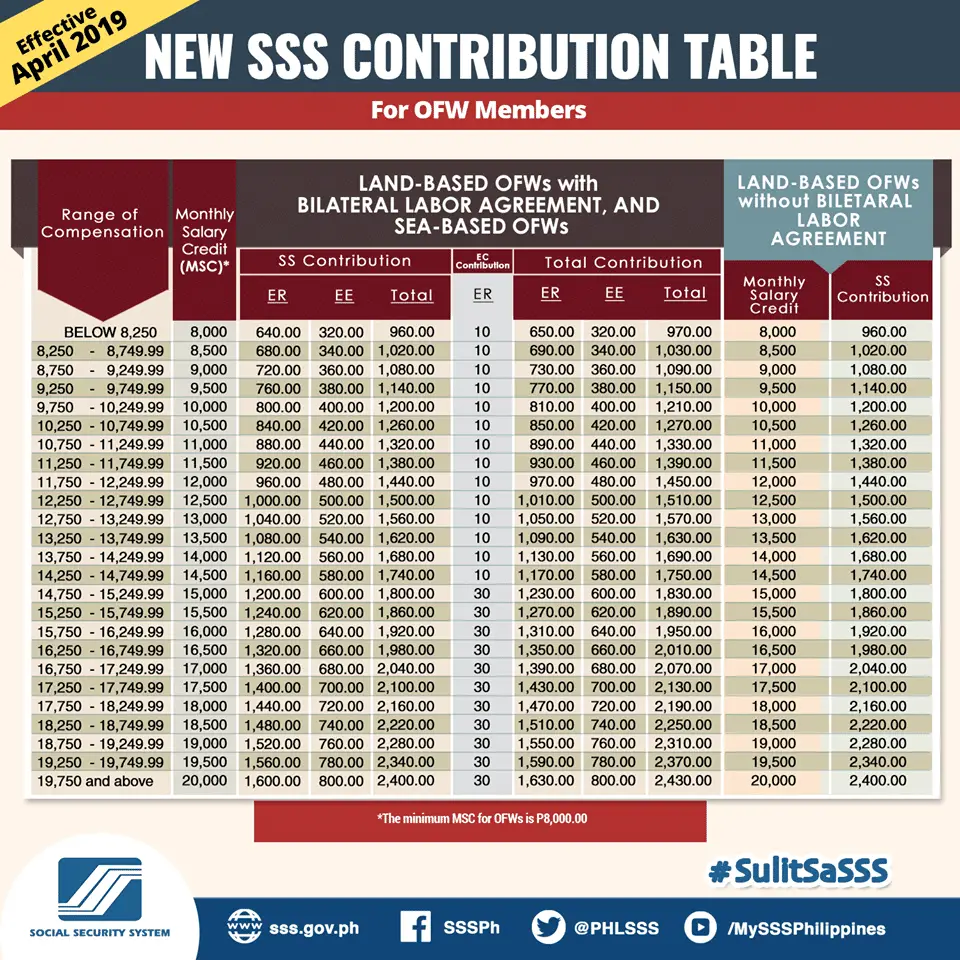

2019 SSS Contribution Table SSS Benefits for Filipinos Sss, Updated in the payment of the sss. Sss contribution table for self.

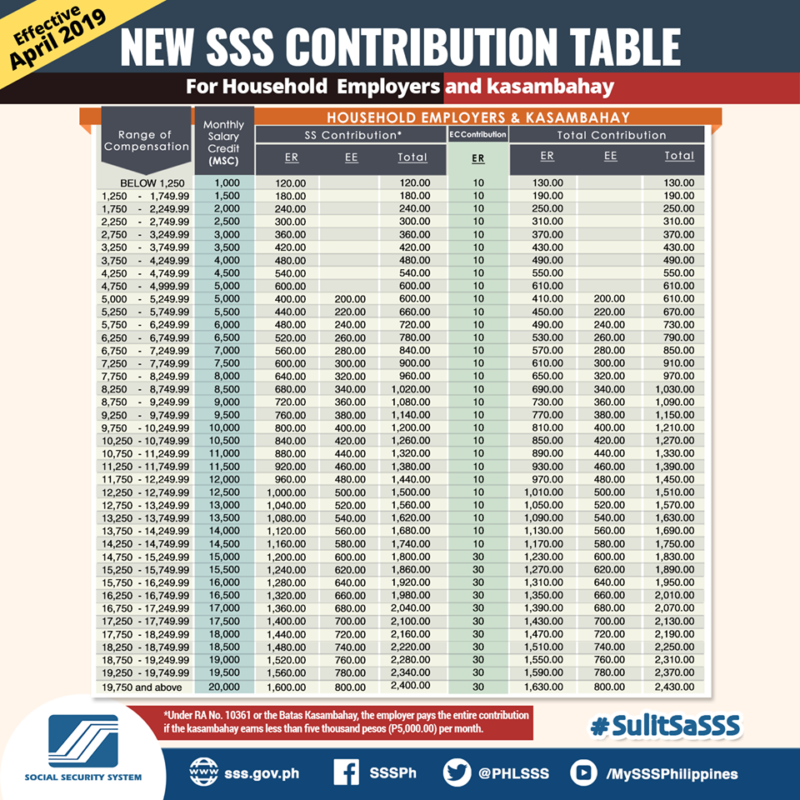

SSS updated table of contributions effective April 1, 2019, Stay updated on your sss contribution with this new sss contribution table 2025. The sss contribution table for household employers and kasambahays provides a.

SSS Monthly Contributions Philippines Employee and Employer Share, Sss contribution tables for 2025: For employees and employers of a company here in the philippines, the changes on the new sss contribution has taken effect since january 2025.

Pin on Quick Saves, Sss contribution tables for 2025: What is the sss contribution rate for 2025?

New SSS Contributions Table and Payment Schedule 2019 SSS Inquiries, Employer (er) and employee (ee) employer (er) refers to the entity or individual who hires employees and is responsible. Sss revamped its contribution structure in january 2025, with a new total rate of 14% based on the monthly salary credit (msc).